Pulse: Growth Outlook and Business Cycle

IMF: A Remarkably Resilient Global Economy, but…

Economic policymakers from around the world are gathered for the Annual World Bank/IMF meetings during a particularly fraught time. In the immediate future, the world faces the potential for a broader war in the Middle East that could lead to a spike in oil prices. In the medium term, geo-economic fragmentation (aka rising protectionism) could affect global growth.

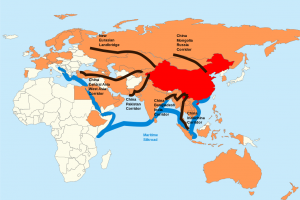

GLOBAL FINANCIAL ARCHITECTURES (PART THREE): CHINA AS A GLOBAL CREDITOR- THE BELT AND ROAD INITIATIVE AND OTHER PROGRAMS

“When you give roses to others, their fragrance lingers on your hand” Chinese President Xi Jin Ping

Global Financial Architectures: A Decoupling

This is the first in a series of articles about global financial developments analyzing the changing Global Financial Architecture in the age of confrontation between the West and the Global South. In the first article, we present the presents the background of the emergence of challenges to the Western-dominated Global Financial Architecture. Other articles will analyze the GFA 2.0 institutions.

China, the BRICS and the Challenge to the US Dollar

In a recent official trip to China, Brazilian President Lula da Silva called for an end of the dominance of the US dollar in world trade, a message that has been echoed by the China, Iran, Russia, as well as other countries. This message reflects the acceleration of the trend towards fragmentation(or deglobalization) of the global economy and the Chinese-led challenge to the Bretton Woods US dollar-dominated global economic architecture, an architecture that looks increasingly frayed and rudderless.

The IMF Upward Growth Revisions: Will the Center Hold?

Upside economic surprises from the United States and the eurozone have underscored the fact that the global economy has performed better in the fourth quarter of last year (4Q22). The US economy expanded by 2.9% (annualized), while the eurozone avoided a recession, with output expanding by 0.1%, quarter-on quarter.

FIG.1 THE IMF UPWARD REVISIONS

A Short-Term Reprieve: The Data

A weaker dollar, falling interest rates, lower inflation and oil prices are offering a welcome, albeit temporary relief to emerging markets.

Bali and Cairo: A Challenging Set of Global issues Meets the Climate Emergency

The Bali Summit is occurring at a time of intensifying challenges facing the global economy.

C’mon, Democrats, Tout Your Economic Record: It’s a Very Good Story

Drawing on the fact-free politics of Donald Trump, Republicans are selling the meme that Americans are much worse off economically and financially under President Joe Biden and the Democrats. That is demonstrably untrue. Yet, the Democrats’ main response has been to mumble an apology for the inflation they didn’t cause and try and change the subject.

by

by

by

by