Rising Risks Haunt Financial Markets

posted by Karim Pakravan on May 23, 2018 - 2:32pm

In the past few weeks, prospects for a successful summit meeting between the President Trump and North Korea’s Kim Jong Un, and the opening of trade negotiations between the U.S. and China had provided some relief to global financial markets. However, the brief respite enjoyed by global financial markets in the past few weeks seems to be over as over as the global risk picture darkens. The major equity indices have been wobbly over the past few weeks and suffered declines since the beginning of this week. The catalog of risks, both geopolitical and financial, has lengthened, as existing issues worsen and new sources of concern arise. Left unresolved, financial markets turmoil could lead to negative concerns for the global economy.

First and foremost, we are seeing a worsening of the geopolitical risks, in large part the result of chaotic and contradictory U.S. policies. A review of these risks follows:

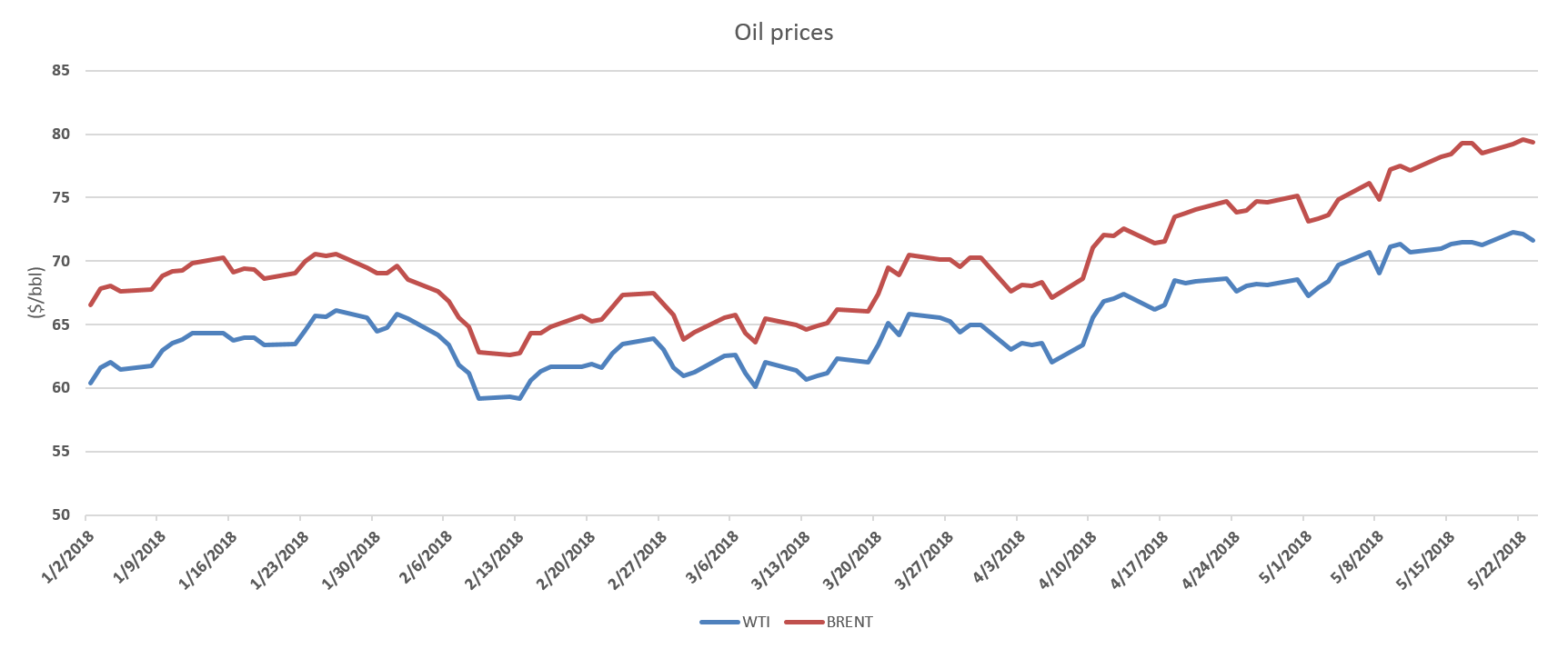

Iran Nuclear deal: The U.S. withdrew from multilateral Iran nuclear deal (aka JCPOA), against the recommendations of his main European allies, as well as the quasi-unanimity of the national security/diplomatic establishment. Iran policy is now driven by Secretary of State Pompeo and National Security Adviser Bolton), as well as hardline allies in the Middle East (Israel and Saudi Arabia). The situation has been complicated further by Pompeo’s recent speech outlining a 12-point list of demands on Iran, accompanied by the threat of unprecedented sanctions in the case of non-compliance by Iran. Of course, Iran is unlikely to comply with the list’s unrealistic demands—ranging from a complete halt to uranium enrichment to exiting from Lebanon and Syria. Furthermore, the United States is increasingly isolated on the issue. The Europeans, China and Russia have stated that they remain in the agreement, ignore U.S. sanctions and work on salvaging the deal and countering the U.S sanctions. So far, Iran has stated that it will continue to comply with the JCPOA, but that commitment could change and the tensions could escalate into an open conflict, with unpredictable consequences. So far, the main impact has been on oil prices, with Brent touching a 30-month high of $80/barrel—up by 20% since the beginning of the year and 8% in the first three weeks of May. A worsening of tensions could lead to a further surge in prices, threatening the global economic recovery

Fig.1: Oil Prices

North Korea: After a brief “honeymoon”, North Korea returned to a tougher stance in the denuclearization negotiations. At the same time, President Trump and his advisors had responded with contradictory statements, which changed on almost a daily basis, President Trump, who wants to cement his place in history —the White House had already ordered a commemorative coin-- seemed to wavering between postponing the summit and be willing to make major concessions. Ultimately, the planned June 12 Trump-Kim summit was cancelled. However, we will not return to the status quo ante. First of all, the China-U.S.-Japan-South Korea united front would be seriously weakened. Furthermore, the failure to ease tensions on the Korean Peninsula and halt North Korea’s nuclear program could lead to renewed threats on both sides. This outcome would embolden the hawks in the Trump administration and lead in the worst case to military action.

Fig.2: Italian Spreads

Italy: The likelihood of a populist and Eurosceptic (Five-Star/League) coalition government in Italy has rattled European financial markets. While the coalition has backed off from its threat to hold a referendum on Eurozone membership, its economic program is focused on reversing many of the previous governments’ economic reforms, which would worsen Italy’s massive debt problem—Italian sovereign debt totals €2.3 trillion (about 120% of GDP), a third of which is held by foreigners. As a result, Italian sovereign debt spreads over German yields has jumped to about 200 bp, the highest level in a year.

Trade Wars: The erratic and contradictory trade policies followed by the trump administration have contributed to the rise of tensions with major trading partners. A tentative and vague trade deal achieved in two days of negotiations last week with China seems to have fallen apart as President Trump reversed himself on key provisions. Trade relations with the European Union have deteriorated as a result of the poisonous atmosphere between the two allies. And NAFTA negotiations are likely to drag on into 2019.

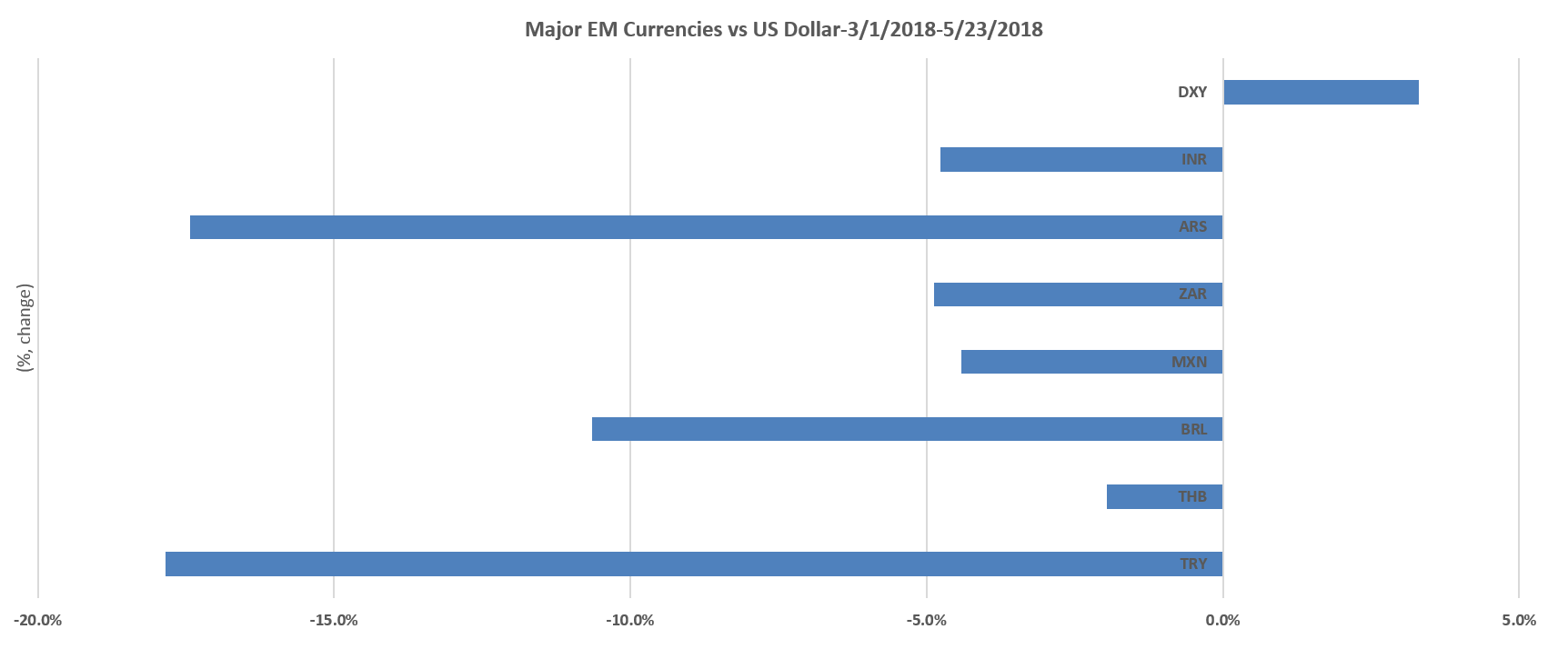

Emerging Markets (EM): concerns about emerging markets have resurfaced after a long period of calm. Two factors have revived these concerns: the strengthening dollar and the rising U.S. interest rates. In combination with a sharp increase in EM foreign currency debt (both sovereign and corporate, estimated at $8.3 trillion, 75% of which is denominated in dollars), this has resulted in a run on major EM currencies, especially those of countries with large current account deficits and /or heavy external debt burdens. Particularly affected have been the Turkish lira and the South African rand, both countries where political turmoil has worsened the impact of widening external gaps. Argentina has also been forced to seek an IMF program. While we don’t foresee another EM financial crisis, the time for complacency in EMs is over.

Fig.3: Emerging Market Currencies

Each of these crises has the potential to be destabilizing for the financial markets and the global economy. Taken together, they present a particularly difficult challenge at a time of uncertain leadership in the United States, deep divisions between the United States and its traditional allies, and the weakening of global financial governance.