Oil Markets in Turmoil: Geopolitical Scenarios

posted by Karim Pakravan on April 13, 2018 - 12:24pm

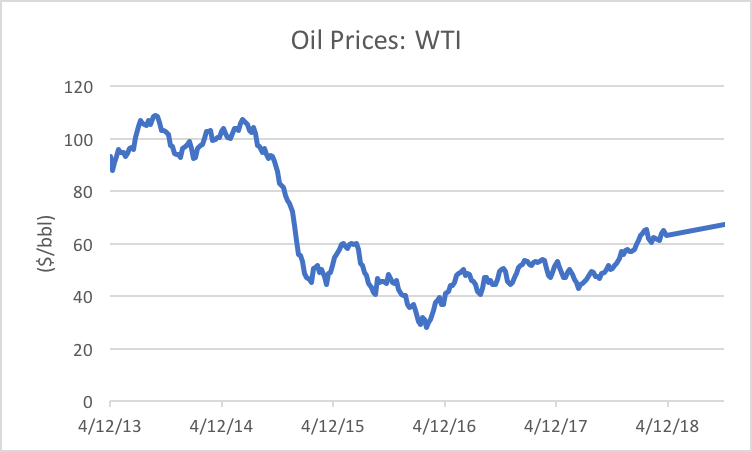

The drums of war have been beating louder in the past few week in the Middle East, roiling the oil markets. Oil process have surged, with the benchmark West Texas Intermediate (WTI) rising to new highs, ending at almost $68.barrel (bbl) at the end of the second week of April, a 13% increase from their 2018 year-to-date low on 2/9. Oil market fundamentals had improved in the last months of 2017: OPEC production cuts had been enforced, major non-OPEC producers such as Russia cooperated in maintaining output discipline, and oil inventories had declined to normal historical levels. Markets entered 2018 in overall supply-demand balance, and here has been little change in oil market fundamentals, However, concerns about rising tensions in the Persian Gulf between the United States and Iran, as well as the Syrian crisis, have been a factor in the price increases.

How can the rising tensions in the Middle East affect oil prices? We can identify a number of scenarios in this regard. As mentioned before, these stem from two key risks.

First, President Trump’s obsession with walking away from the multilateral nuclear deal with Iran (aka JCPOA) has been bolstered by the appointment of hardliners such as CIA Director Michael Pompeo as Secretary of State and John Bolton as National Security Advisor. The only voice in the Administration which is currently supporting (reluctantly at best) the deal is Secretary of Defense Mattis, who seems to be following the advice of the majority of the national security/diplomacy establishment. Other regional actors such as Saudi Arabia and Israel are also stoking the fires, intent on sinking the JCPOA and eventually sparking a military confrontation between the United States and Iran.

Pompeo has since scaled back some of his hardline rhetoric in his recent confirmation hearings in the Senate. Nevertheless, in the final analysis, any decision in this regard will be President Trump’s and his alone. Ending the deal could lead to military conflict with Iran. In the best case, such an outcome would lead to a temporary interruption in oil supplies from the region. In the worst case, the war could draw in Saudi Arabia and the UAE, which could lead to a permanent crippling of oil terminals and massive supply disruptions. Alternatively, Trump could choose to decertify the deal and impose sanctions on Iranian oil exports, which could also have a major impact on oil supplies. Iran currently produces about 3.8 mbd).

Second, while Syria itself is a minor oil producer, the Syrian conflict has become a world war by proxy. Following the chemical attacks by the Assad regime against his own population, a military response by the U.S. (and major European powers) has become almost inevitable. Such a response could lead to military conflict between the United States and Iran (or Iranian proxies) and a spreading of the conflict to the Persian Gulf, or at the very least new U.S. sanctions against Iran. In all these cases, we are looking with the potentially disastrous outcomes outlined above.

The current turmoil in oil markets has already led to sharply higher prices. Any worsening of the regional tensions will lead to even higher prices, and the breakout of military confrontations would lead to a dangerous surge in prices which could tank global financial markets and push the United States and the world into another recession. We can only hope that cooler minds will prevail.