Oil Market Realities: The Trump Administration Roils Oil Markets

posted by Karim Pakravan on July 16, 2018 - 11:58am

Oil prices (West Texas Intermediate, WTI) surged by 12.7% in June, to reach a 44-month high of $74.15/barrel (bbl) at the end of the month. Brent also surged to close to $80/bbl. While the loss of Venezuelan production and temporary disruptions in Libya’s crude output are the proximate cause of the oil price increase, conflicting policies of the Trump administration are at the center of the price surge. On one hand, President Trump is pushing to shut off completely Iranian exports by November, threatening Iranian oil importers with secondary sanctions-- currently, Iran exports 2.125 MBD. On the other, higher oil (and gasoline) prices are having a negative impact on the American households. So the president is pressuring the Saudis to increase production to full capacity by adding 2 millions of barrels per day (MBD). Already, OPEC and Russia had agreed to increase output by 1 MBD by the end of the year at their June 22 meeting. Furthermore, Saudi Arabia already upped its crude output by 408 thousands of barrels per day (TBD) in June, to 10.5 MBD).

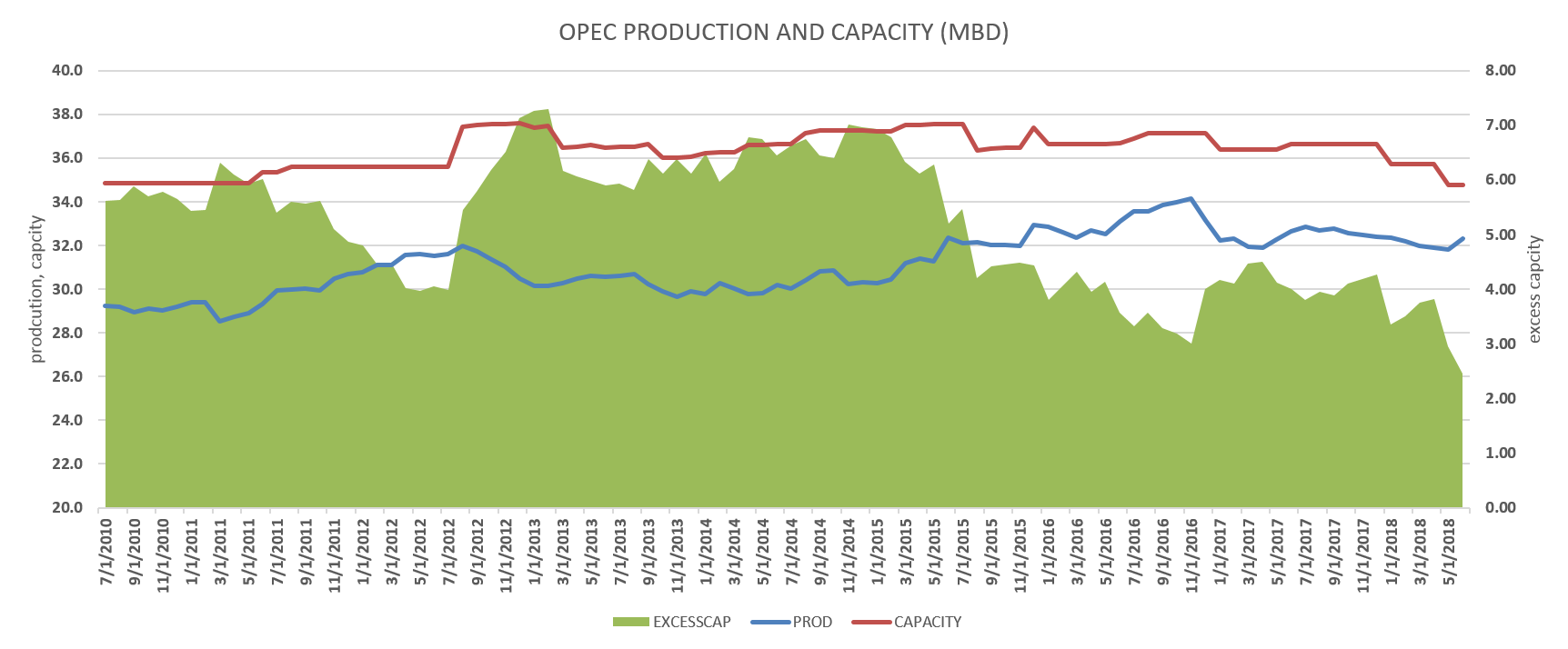

Fig. 1: OPEC

However, the margin for maneuver in oil markets is very limited. Here are some facts to consider:

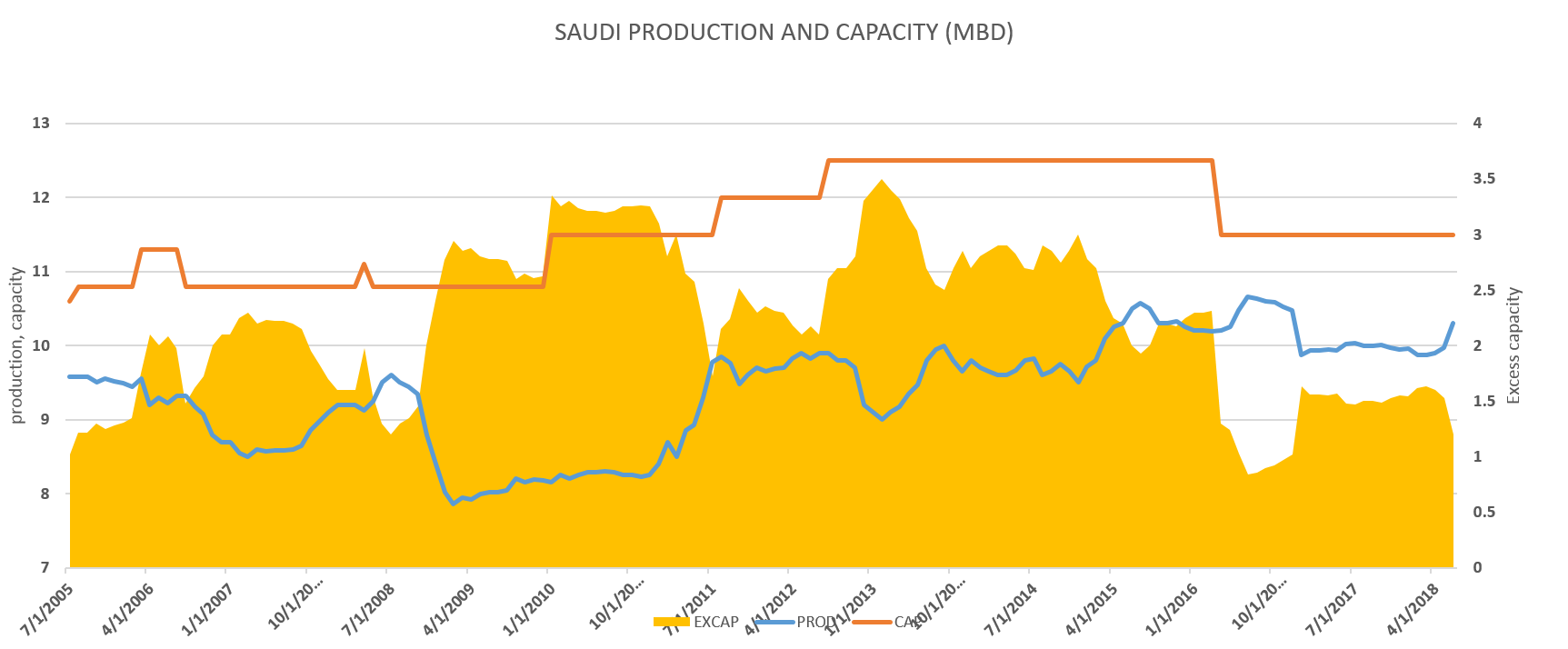

1. OPEC excess capacity is limited, probably in the range of 2.5 MBD, with about half of it in Saudi Arabia, with smaller amounts in Kuwait and the UAE. Furthermore, most of the excess capacity exists on paper only. Actually, the Saudis have never produced more than 10.7 MBD in the past decade, only more than its current output. The Saudi oil minister has stated that pumping oil at full capacity will strain the oilfields capacity and is not likely to be sustained for a long period of time. Other OPEC members also could be reluctant to increase production

Fig.2: Saudi Arabia

2. Iran currently produces 3.8 MBD, about 1.2 MBD more than prior to the JCPOA agreement, which removed the oil embargo against the country. While pressure from the United States has resulted in some cutbacks in oil imports from Iran by European countries, production and exports are holding. In fact, exports very limited amounts to Europe, with the bulk of Iran’s exports going to Asia--with India and China each taking 600 TBD.

3. While Russia has basically followed OPEC in curbing output, it has very little excess capacity. The United States, now the largest crude producer in the world, depends on shale oil to expand capacity. Current production expansion is already constrained by limited pipeline capacity

4. Global demand for oil is rising, up by 1.2 MBD in 2017, to 97.8 MBD, and expected by the International Energy Agency to increase to over 100 MBD by the end of 2018.

5. Pressure from the U.S. is unlikely to cut off Iranian oil exports completely. Iran was able still to produce 2.6 MBD (and export over 1 MBD) at the height of the multilateral sanctions against the country prior to the JCPOA.

6. All-in-all, in the event the U.S. succeeds in cutting off Iranian exports completely, it would be difficult to replace the lost crude. This would leave the oil market’s fragile supply-demand equilibrium vulnerable to other disruptions in crude output (Venezuela, Libya, Nigeria)

6. And now, the geopolitics. Among the key factors, we can list the following:

- Relations between the both United States and its main European allies on one hand, and between the country and China on the other, have considerably worsened in the recent months. Trade tensions and bullying by the U.S. President make it unlikely that other countries will fully abide by the U.S. embargo on Iranian oil, and the United States’ threats of secondary sanctions could well backfire.

- Russia is unlikely to cooperate with the United States on Iran. On the contrary, Putin is using the opportunity to deepen its relationship with the Islamic Republic

- Iran has threatened to close the Strait of Hormuz in the event of a U.S.-imposed embargo. While such a move is unlikely, rising military tensions in the Persian Gulf could lead to confrontation. While the Arab countries of the Persian Gulf, as well as Israel, are eager to provoke a US-Iran confrontation, such an outcome would have unpredictable consequences.

The bottom line is that the typically confusing, aggressive and contradictory Trump approach to the issue is creating further uncertainties in an already nervous oil market. Oil prices have fallen, recently, with WTI under $70/bbl. The U.S. is also considering releasing some oil supplies from the Strategic Petroleum Reserve. Faced with these realities, the more reasonable voices in the Trump administration seem to be pulling back from the maximalist position, with Secretary of State Pompeo hinting at some flexibility in providing waivers to some importers of Iranian oil.