Money20/20 2016

posted by Collin Canright on October 24, 2016 - 10:35am

I am attending the annual Money20/20 FinTech conference in Las Vegas this week. Here is a summary of this week's FinTech related links:

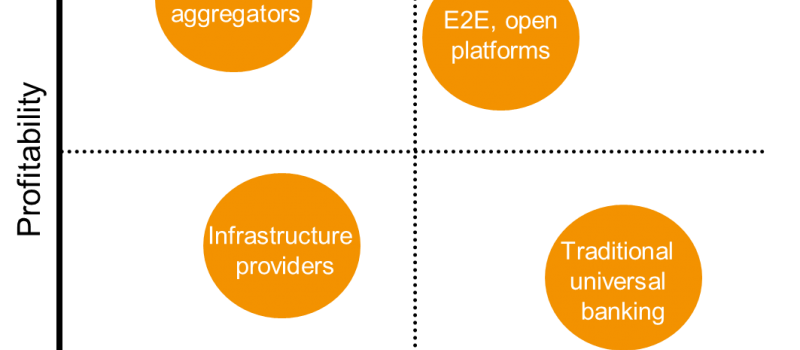

Four banking business models for the digital age

“The traditional universal banking model and the infrastructure provider model are both asset intensive and low margin, which makes them unattractive,” writes Ben Robinson, chief strategy & marketing officer at Temenos, in a post for LinkedIn Pulse. Robinson breaks down the different business models for banks leading into the digital age.

ABA unveils FinTech Playbook for bank CEOs

The FinTech Playbook examines technologies at all levels and in all areas of the business, according to a release from the American Bankers Association, which released the report Oct. 17. The project also puts forth recommendations as to how to attract more millennials to FinTech.

24 Chicago FinTech companies revolutionizing financial services

Chicago’s history as a trading and banking city combined with an influx of tech-savvy financial professionals have made the Windy City a prime city for FinTech innovation. From Guaranteed Rate’s lending platform to Envestnet’s wealth management tools, Built in Chicago has rounded up 24 FinTech companies addressing the financial service industry’s biggest challenges.

Peer-to-peer lending is alive and stronger than ever

“P2P lending is not dead. It’s just growing up,” writes Jorge Newbery, CEO of Homeowner Preservation, in a blog post for The Huffington Post. Peer-to-peer lending platforms, which started off as a sort of financial matchmaking services between investors and consumers, has matured into a Wall Street darling.

Ripple CEO suggests next U.S. President appoint a FinTech advisor

With little talk of financial technology innovation during the presidential campaign, Ripple CEO Chris Larsen called for a FinTech to be appointed following the presidential election. This would facilitate greater cooperation between the tech sector and Washington, pointing to how past relationships between the two drove adoption of technology and the internet in the ’90s. Cryptocoins News has the full story.

Goldman’s online lender, Marcus, opens (to those with the code)

Through the new platform, borrowers will be able to apply for loans up to $30,000 to refinance their credit card debt or pay for household projects, The New York Times reports. The move represents the firm’s attempt to navigate regulatory and reputational challenges since the financial crisis.

THE BLOCKCHAIN WATCH

Hyperledger at Money20/20

Brian Behlendorf, executive director at Hyperledger, will speak during the Oct. 25 blockchain panel, “All Together Now: How Bank & Tech Partnerships Are Shaping the Future of Blockchain” at the Money20/20 conference in Las Vegas. For more updates, be sure to follow Collin Canright on Twitter for Money20/20 insider insights.

IBM studies: banks, financial markets institutions ramp up blockchain development

In two new reports based on separate surveys, IBM found that banks and other financial institutions aim to harness the power of blockchain to stay ahead of FinTech competitors. According to FinTechnews Switzerland, 70% of early-adopters said that they are focusing their blockchain efforts in four key areas: clearing and settlements, wholesale payments, equity and debt issuance and reference data.

Central banks consider bitcoin’s technology, if not bitcoin

Central bankers, the Bank of England and the People’s Bank of China, in particular, want to tap into blockchainin order to quickly and efficiently complete and keep track of transactions, according to The New York Times. Implementing blockchain solutions would cut operating costs and promote greater transparency between the international central banks.