‘Tariff War’ Flares Up, But Deal Still Likely Later this Year

posted by Michael Lewis on May 10, 2019 - 12:00am

Today, five days after he tweeted this deadline and nine months since he first declared the intention to do so, President Trump raised the tariff on $200B of imports from China from the +10% first applied in March 2018 to +25%. The action follows China’s message to U.S. negotiators backtracking on a number of earlier promises to increase intellectual property protections.

While China officials will surely raise their tariffs in retaliation, they have not yet announced the details, despite having a week’s notice of this deadline. Moreover, China’s Vice Premier stayed in Washington to finish this week’s negotiation session as scheduled, rather than storming out. This implies that, as Trump says, “talks with China continue in a very congenial manner.” Chinese officials confirmed that the talks went “fairly well.”

Also, the added U.S. levy will be charged on goods shipped after today, not those already in transit. Typically, those imports take three weeks to reach the U.S. by sea. So there is still a window to reach a deal and rollback the tariffs.

On the other hand, Trump has also declared his willingness to throw a +25% tariff on the remaining $300B of imports from China if the talks do not go well.

FMI’s best guess is that these added tariffs -- and China’s retaliatory moves -- will take effect, but we continue to expect that a trade agreement will be reached later this year.

China, we believe, is gambling that Trump needs to make a deal as he heads into a re-election campaign. They are making the same mistake that North Korea did last year in de-nuclearization talks. In both cases, Trump walked away from the table rather than take a “bad” deal. It’s almost like he has written books on the subject…

China’s leaders may have been watching too many U.S. cable news pundits complaining about the dire effects of tariffs on the U.S. economy. Trump knows, however, that the vast majority of voters have not felt any meaningful adverse impact. The tariffs, even at these new higher rates, comprise only a modest fraction of the final price of consumer goods. And exporting firms are absorbing a good portion of the costs to maintain their share of the lucrative U.S. market.

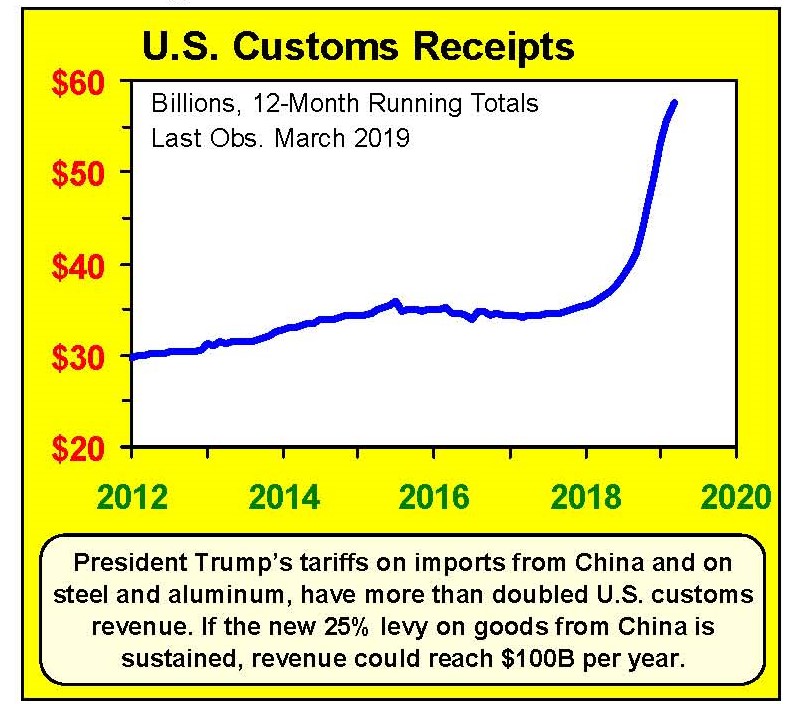

Politically, Trump stands to lose more from appearing to kowtow to China demands than from disgruntled U.S. farmers or consumers. Especially since the new tariffs would generate tens of billions of dollars in federal revenue that would be redirected to “emergency” relief for those hurt by the tariffs.

In any case, China will likely soon return to the bargaining table because the issues that they want to “backtrack” are not that important to them. The main dispute is over requirements that China change its laws to protect intellectual property rather than simply pledging to change policy. Either way, China will not fulfill those commitments. The Communist Party can ignore any law it chooses. Trump, however, needs that glorified window dressing to show that he won a better deal than his predecessors.

In the final deal, China will likely increase imports of U.S. goods to clearly above the pre-tariff baseline. Easy enough for them to do, in part by cutting farm imports from other nations. China will pencil in reforms on IP et al but actual change will be minimal.